| 505 E. Huntland Drive, Suite 380, Austin, TX 78752-3757 |

| The mission of the Texas State Board of Public Accountancy is to protect the public by ensuring that persons issued certificates as certified public accountants possess the necessary education, skills, and capabilities and that they perform competently in the profession of public accountancy. |

|

TSBPA General Information

October 13, 2022

Firm License Renewals due November 30, 2022 can now be paid Online

Use Online Services for Firms to manage all phases of the annual renewal process.

October 13, 2022

Individual License Renewals due November 30, 2022 can now be paid Online

Use Online Services for Individuals to manage all phases of the annual renewal process.

September 30, 2022

Register for the Accounting Educators' Webinar

Wednesday, November 9, 2022

9 a.m. - 11 a.m. CST

The Texas State Board of Public Accountancy Qualifications Committee will be presenting a webinar with information for accounting educators in preparation for the new CPA Exam format that is scheduled to launch in January 2024.

REGISTER NOW

* may work best with Google Chrome browser

September 6, 2022

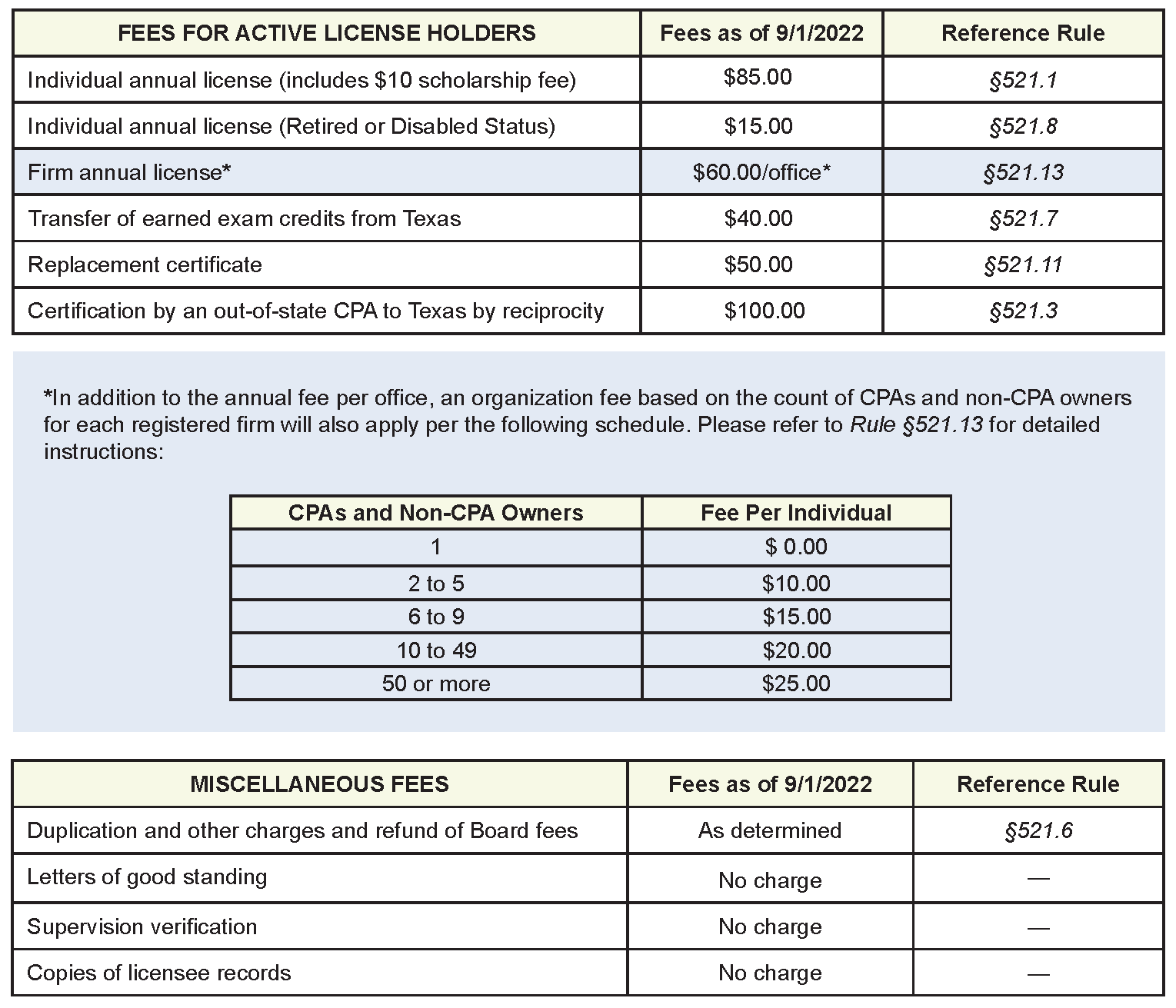

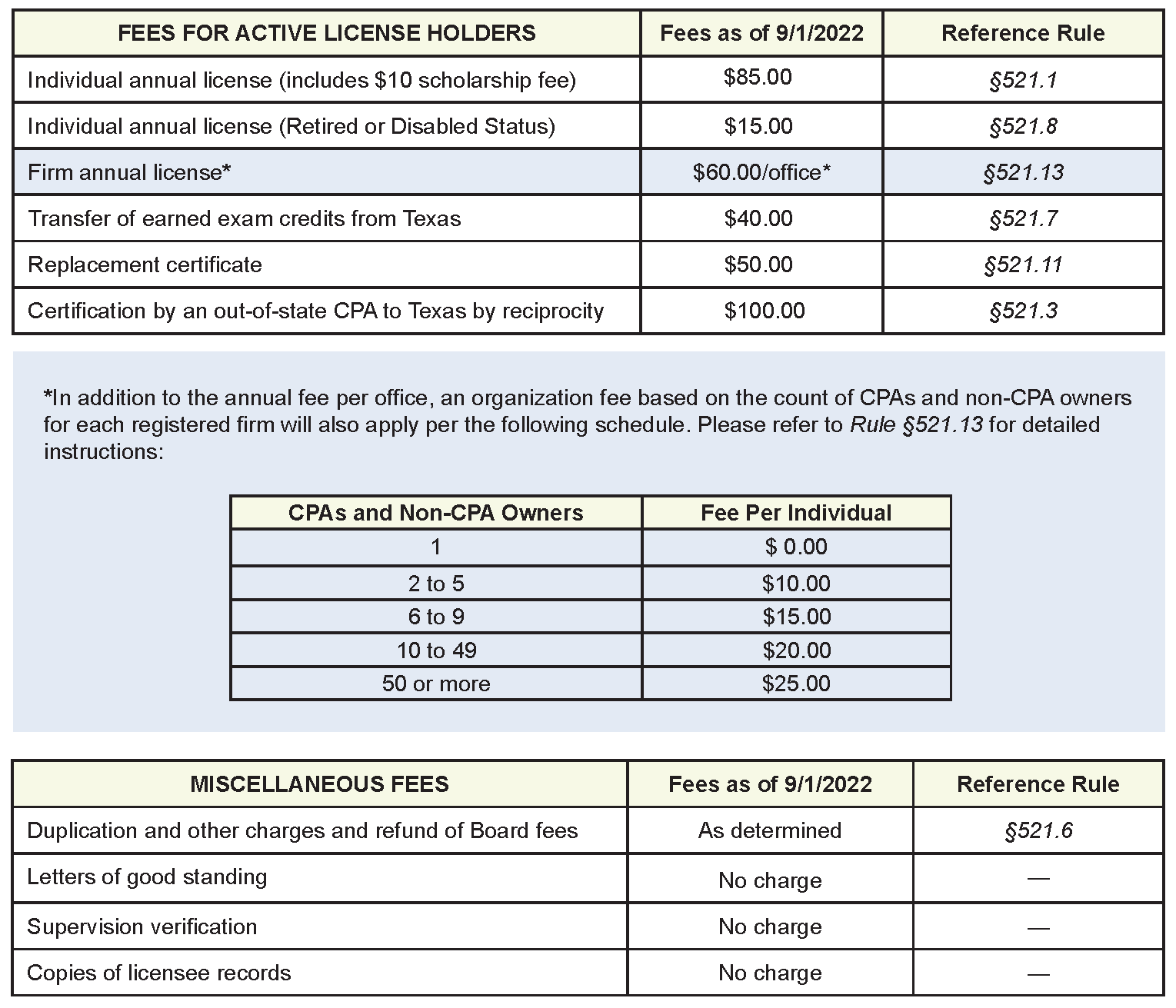

Individual License Fee Increase

As a result of the Board's projected revenue, expenditures, and fund balances, modest fee increases are necessary to maintain the same level of operations for Texas licensees. Effective September 1, 2022, the annual individual license fee will increase from $70 to $85 (includes $10 scholarship fee). All other fees will remain the same. The Board has not increased fees for licensees since September of 2019 and in 2021 the overall license renewal fee was reduced. The Board is self-sustaining. All direct and indirect costs must be paid from what it collects in license renewal fees, firm registrations, exam fees, sponsor registrations, and other collections.

The following table can be used as a general guide, but your individual fees may vary depending on your specific circumstances, the timing of your previous payments, and your current status with the Board. Please refer to Online Services for Individuals to check your specific status.

August 9, 2022

Firm License Renewals due September 30, 2022 can now be paid Online

Use Online Services for Firms to manage all phases of the annual renewal process.

August 9, 2022

Individual License Renewals due September 30, 2022 can now be paid Online

Use Online Services for Individuals to manage all phases of the annual renewal process.

April 4, 2022

Fingerprinting Exemptions

The deadline for Texas CPAs to complete the fingerprint-based background check is August 31, 2022. Texas CPAs residing outside of the state and Texas CPAs that have a CPE exemption are still required to be fingerprinted. The only exemption from fingerprinting is to be eligible for and claim a retired or disabled license status with the Board prior to the August 31, 2022 deadline.

To check your fingerprinting status or learn how to complete this requirement, simply follow the instructions on your account page after logging into Online Services on the TSBPA website. Please refer to the Frequently Asked Questions page for more information.

September 1, 2021

Fingerprint-Based Background Check Updates

If you have not already completed the fingerprint-based background check, Senate Bill 297 extended the deadline for Texas CPAs to August 31, 2022.

Licensees who hold the retired or disabled status with the Board do not need to get fingerprinted, unless they seek reinstatement.

To check your fingerprinting status or learn how to complete this requirement, simply follow the instructions on your account page after logging into Online Services on the TSBPA website. Please refer to the Frequently Asked Questions page for more information.

August 25, 2020

• We've Moved!

to 505 E. Huntland Drive, Suite 380 Austin, TX 78752

–

Contact Information

|

Follow us

Follow us