At BLS, we highly value feedback that can help us improve our economic statistics. Three groups regularly advise us on serving the needs of data users: the BLS Data Users Advisory Committee, the BLS Technical Advisory Committee, and the Federal Economic Statistics Advisory Committee.

I cannot overstate the value of these committees. They have given us truly wonderful ideas. If you want to join these meetings, they are open to the public. You can learn more about future meetings directly from the committee links provided above. I welcome and encourage you to attend.

As the Commissioner of BLS, my role at these meetings is to give an overview of all the new and exciting things happening at BLS. I want to share these updates directly with you, too.

Budgets for Fiscal Years 2022 and 2023

Let’s start with the budgets for fiscal years (FY) 2022 and 2023. For full information on the FY 2022 budget, please see the Department of Labor FY 2022 budget page, which has information on the budget for BLS and other agencies within the Department. You also can see the FY 2023 proposed budget, released on March 28, 2022.

In addition to funding our existing programs, the President’s FY 2023 proposed budget requests additional funds for several BLS initiatives.

We are requesting $14.5 million to continue developing a new National Longitudinal Survey of Youth cohort. We are developing plans for a new cohort called the National Longitudinal Survey of Youth 2026 (NLSY26). The NLSY26 will build upon our experience and analysis of two ongoing earlier cohorts:

- NLSY79: A sample of 12,686 people who were born in the years 1957–64. The survey began in 1979, when sample members were ages 14–22. BLS has followed this cohort of late baby boomers for more than 40 years, recording their lives from their teens into their 50s and early 60s.

- NLSY97: A sample of 8,984 people who were born in the years 1980–84. The survey began in 1997, when sample members were ages 12–17. BLS has followed this cohort for more than 20 years, and sample members are now in their mid-30s to early 40s.

As in previous National Longitudinal Surveys cohorts, BLS plans to ask NLSY26 cohort members a core set of questions on employment, training, education, income, assets, marital status, fertility, health, and occupational and geographic mobility. We also plan to administer cognitive and noncognitive assessments. We are considering other topics as we consult with stakeholders and subject matter experts in a range of fields.

The FY 2023 budget request for BLS also includes the following:

- $11.9 million to produce data to support the U.S. Census Bureau’s Supplemental Poverty Measure, to research the nature and construction of a consumption-based poverty measure, and to research a chained Consumer Price Index for low-income households.

- $9.6 million to publish monthly Job Openings and Labor Turnover Survey data earlier and expand the data.

- $1.1 million to restore agricultural industries to the Occupational Employment and Wage Statistics program.

- $1 million to enhance the Consumer Price Index by reducing the current lag in the publication of the final chained CPI by 3 months.

Expanding Our Data

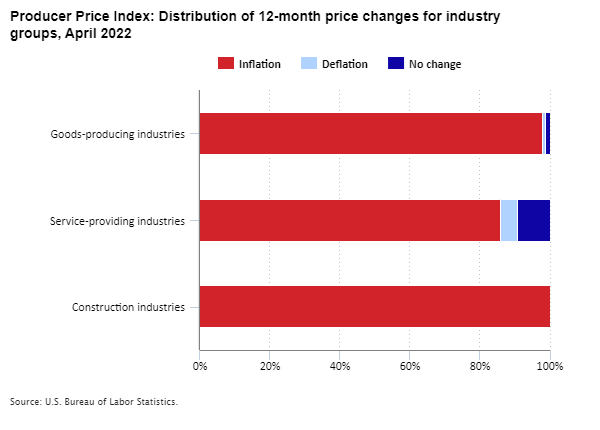

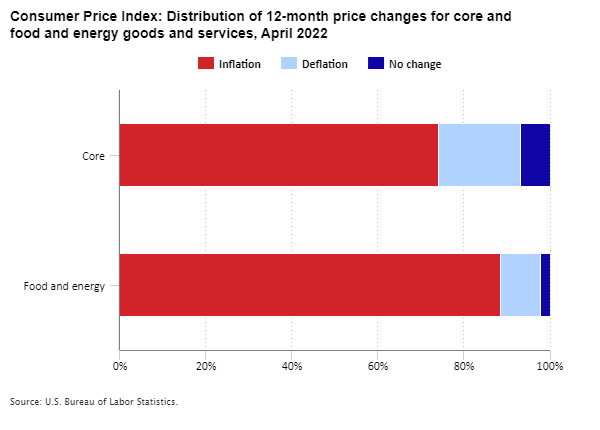

Moving beyond the budget, one topic that’s getting a lot of attention lately is inflation. We’ve been measuring and reporting on inflation at BLS for over a century, and we are always looking for ways to improve our measurement. The National Academy of Sciences, Committee on National Statistics, recently completed a study that focuses on ways to improve the Consumer Price Index. The report provided 37 consensus recommendations on how BLS can adapt to the rapidly changing digital landscape to improve CPI methods. BLS staff are now reviewing the report and developing an action plan based on the committee’s recommendations. You can read my blog about the report and the full report itself.

BLS recently began publishing monthly and quarterly labor force measures for the American Indian and Alaska Native population on February 4, 2022. We have these data back to 2000. Previously, we published data for American Indians and Alaska Natives only annually. You can learn more about the new data in one of my February blog posts.

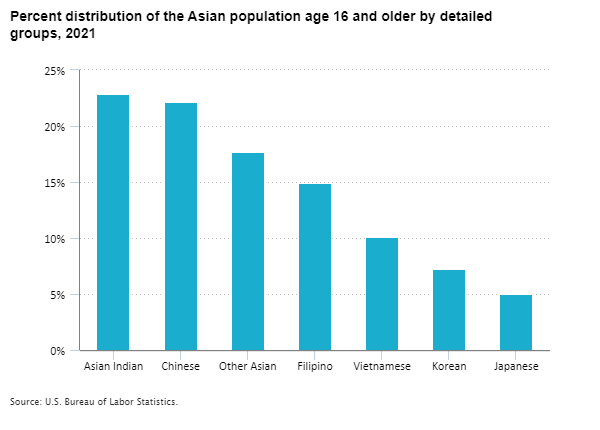

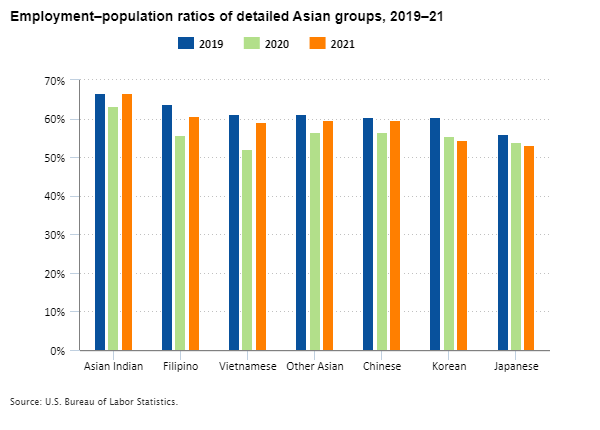

We now are evaluating whether we can begin publishing monthly and quarterly labor force data for the Native Hawaiian and Pacific Islander population and for detailed Asian groups. The populations of Native Hawaiians and Pacific Islanders and detailed Asian groups are relatively small, so we need to evaluate whether the Current Population Survey sample size is large enough to produce reliable monthly estimates for these groups. We currently publish annual data for Native Hawaiians and Pacific Islanders and detailed Asian groups in our report on Labor Force Characteristics by Race and Ethnicity.

Updates for Other Programs

I mentioned the National Longitudinal Surveys already, but the program is also doing other great work! In November 2021 we released data for the NLSY97 COVID-19 Supplement. We collected these data from February to May 2021. The survey asked questions about how the pandemic affected employment, health, and childcare. See our brief analysis of some of the COVID-19 data.

We’re also exploring how to measure the value of household production. BLS contracted with a vendor to consider how to use data from the American Time Use Survey on home production and impute the data to consumer units in the Consumer Expenditure Surveys. We expect to receive the recommendations by the end of the fiscal year.

Also in our Consumer Expenditure Surveys, we conducted an online survey test from November 2021 through January 2022 that will help us analyze alternative methods of collecting data. Response rates for most surveys have been declining for years. The COVID-19 pandemic also has made in-person interviewing less feasible. We are currently analyzing the results of the test to learn how we might reverse the trend of declining response rates and be ready for future events that might disrupt data collection.

Finally, we revamped the BLS Productivity program’s web space in April 2022. Information on labor productivity and total factor productivity is now available in a single cohesive and intuitive space. The new web space eliminates redundant material, improves consistency, and includes new material to fill information gaps. It truly enhances the customer experience!

I hope you find these updates useful and that they improve your experience with BLS data. We are always looking for opportunities to improve your experience with our gold standard economic statistics. Be on the lookout for more updates and improvements as we continuously adapt to meet your needs!

United States Department of Labor

United States Department of Labor