Think like a CEO: Top 5 countries, industries, and tech for new ventures

Global CEOs showcase hot opportunities for new business ventures.

Download the infographic

Entrepreneurs have always found opportunity in difficult environments, from Microsoft’s founding in the mid-1970s stagflation era to Google’s rise after the dotcom bust to Facebook’s blossoming amid the Great Recession. Even IBM’s earliest beginning, more than a century ago, came in the middle of a two-year-long economic panic.

So where is opportunity showing itself now, for those intrepid enough to start a business in the teeth of pandemic uncertainty? The answers, according to some of the world’s most knowledgeable and accomplished business leaders, are alternately intriguing, reinforcing and a bit head-scratching.

Where is opportunity showing itself for those intrepid enough to start a business in the teeth of pandemic uncertainty?

The IBM Institute for Business Value (IBV) has conducted an in-depth survey of more than 3,000 CEOs around the globe, as well as extensive, exclusive one-on-one interviews with more than two dozen chief executives whose organizations have been among the most successful amid pandemic-era dislocations. The results of this breakthrough CEO Study will be released in early 2021, as part of a comprehensive portfolio of C-Suite insights. But we’re sharing a preview now, focused squarely on entrepreneurial opportunity.

Donning an entrepreneur’s hat: What would you do?

As part of its research, the IBV asked CEOs to provide open-ended answers to 3 straightforward questions about starting a new business now:

- If you were launching something new today, what country would you most want to choose for your venture?

- What industry would you most want to focus on?

- What technology would be most critical in making the venture a success?

With CEO respondents spread across myriad geographies and industries, the IBV expected a broad range of answers. Yet the focus is remarkably tight. The top 5 cited countries comprised more than 40% of all answers, and the same top 5 industries were chosen by nearly 50% of CEOs. The top 5 technologies, meanwhile, were noted in aggregate by nearly 75% of respondents.

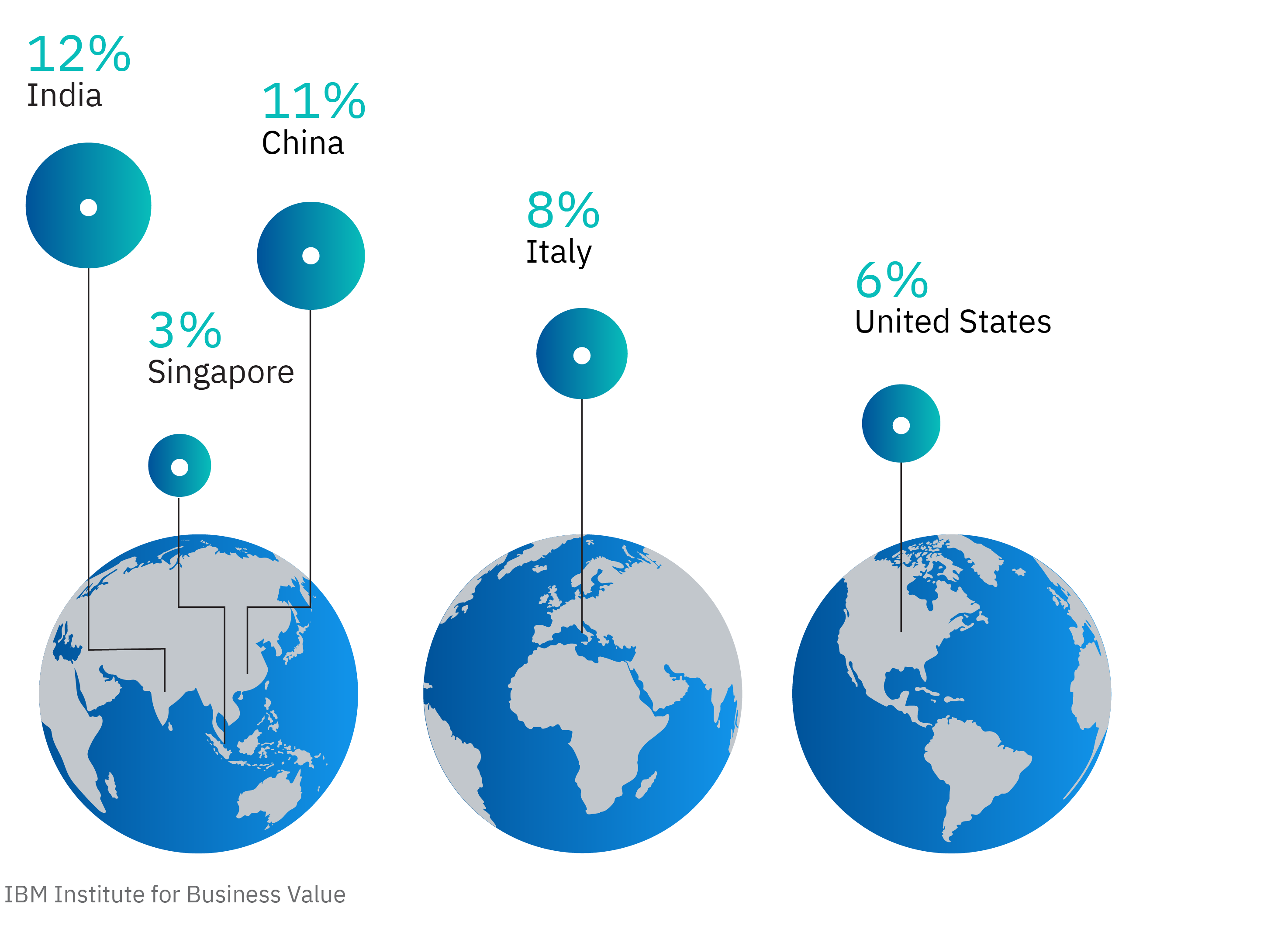

Considering a change of scenery: Top 5 business locations

The most-cited location for starting a new business is India, with nearly 12% of CEOs identifying it as their choice spot. (Only 4% of survey respondents are India-based.) In the second spot, with just over 11% of respondents identifying it, is China. (About 5% of respondents are from China.) This grouping of India and China at the top reflects both the growth potential in those economies and the still-open paths for scaling presented by their huge domestic markets.

The third most-cited country, at 8%, is certainly a surprise: Italy. (Just 3% of respondents hail from Italy.) While hardly boasting the fastest-growing economy, Italy may present particular opportunity because of the early disruption it experienced from COVID-19; a new entrant might be more able to take advantage of openings at the expense of legacy players.

This grouping of India and China at the top reflects the growth potential in those economies.

Fourth on the CEOs’ list of where to locate a new business is the US, identified by 6% of respondents. Yet the study’s overall pool of CEOs includes an even larger 8% who are US-based. That means, despite the high ranking of the US, a considerable proportion of CEOs working there see brighter opportunity in other geographies.

Placing fifth on the country list is Singapore, with a much lower 3%. Yet that still put it ahead of Germany, Brazil, and Japan, which each received 2% or less support.

Location, location, location

3 of the 5 countries most CEOs would choose for a new venture are in Asia.

Getting down to business: Top 5 industries

With geographical preferences revealed, it’s notable that the most-mentioned industries for starting a new business tell a different sort of story. Most popular, identified by nearly 12% of respondents, is the financial services sector. Noted for historical-high margins and relatively low fixed costs, financial services provides a compelling risk-return tradeoff, particularly in a period when flexibility is increasingly prized.

In the second spot, with more than 9% share, is retail. While mom-and-pop stores may be under pressure in some markets, CEOs seem to be focusing on the continuing power of consumer-products spending, as well as the relative advantage that newer, e-commerce enabled retailers might exploit.

The financial services sector offers a compelling risk-return tradeoff in a period when flexibility is increasingly prized.

Third on the industry list, at 9%, is a perhaps surprising sector: manufacturing. High fixed costs, capital investment needs, and supply-chain dependencies have often generated particularly difficult challenges for manufacturers over the past year. Yet CEOs seem to recognize the value of tangible production, even in an increasingly digital-focused world. And if a new manufacturing startup begins with imbedded digital capabilities, its potential to gain share is tempting.

Fourth on the list: consumer products, with just under 9% of CEO respondents naming the category as their preferred new-business area. With a new era underway, new habits can open the door to new brands. Those attuned to the times, and to shoppers’ current needs, can build new, meaningful, profitable customer allegiances.

Finally, in fifth position, and perhaps expectedly: healthcare. About 5% of CEOs surveyed pointed to the opportunity for new businesses in health, as we all focus on our own well-being in new ways in the wake of COVID-19.

Industries of choice

The same top 5 industries were selected by nearly half of CEOs.

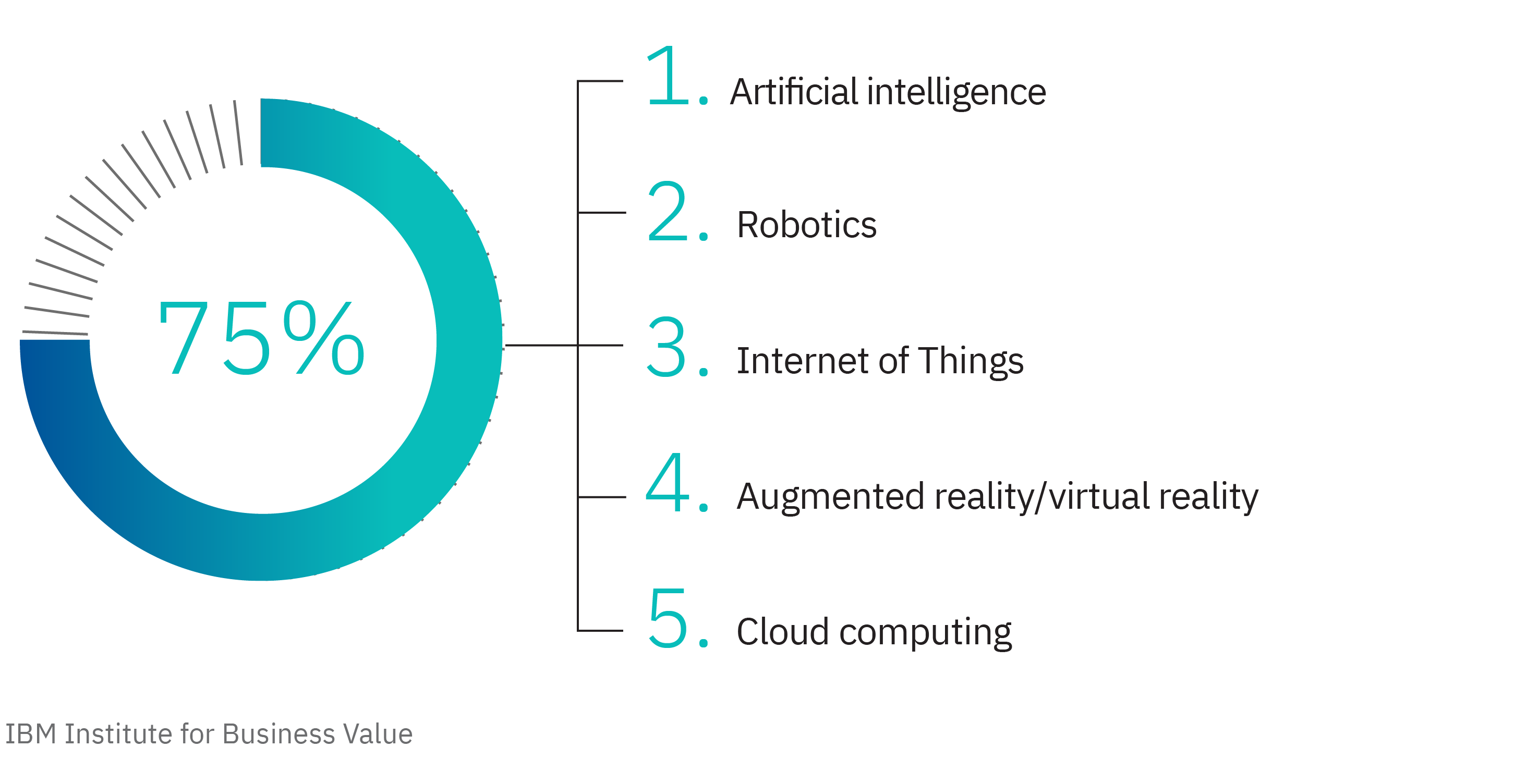

Pursuing business breakthroughs: Top 5 technologies

So, what technologies will be most important in enabling these theoretical new businesses? The top 5 list underscores the significance of newer, emerging technologies. Artificial Intelligence (AI) is the most commonly cited technology. The next two answers, in close proximity to each other: robotics and Internet of Things (IoT) technology.

Does this all mean that an AI-based financial services business in India would be the best-bet, most successful new startup right now?

Next up: the nascent but fast-growing realm of augmented reality/virtual reality (AR/VR), which seems to be coming of age quickly. And rounding out the top 5 is cloud computing, the central enabling technology. The interaction and interdependence of AI, robotics, IoT, AR/VR, and cloud illuminates how CEOs expect these areas to define the future of the economy.

Necessary tech

Almost 75% of CEOs named these 5 technologies as key to success.

Does this all mean that an AI-based financial services business in India would be the best-bet, most successful new startup at the moment? Only time—and high-level execution—will tell. For now, at least according to these 3,000 top executives, that’s where the odds look most promising.

The IBV’s full CEO Study will be out in early 2021 with far more detailed data and insights about best practices for success in our much-altered global economy–and what will drive opportunity for businesses of all ages and sizes in the years ahead.

Check this link to see the full report when it’s available.